This document compiles all the relevant insights shared through our Discord community regarding the use of FUTURES instruments with IG broker via the ProRealTime platform. Its purpose is to provide a clear and complete understanding of IG Futures, how they work, their benefits and limitations, and how they interact with CFD AutoTrading systems (AUTOTRADING.EE)

And even if you don’t use our systems or algorithmic trading in general, the following information will also be useful for your manual trading.

Versioning

13th March 2025 – Initial version

Disclaimer

This article is for informational and educational purposes only and does not constitute financial advice, investment recommendations, or an endorsement of any broker or financial product. We are not commercially affiliated with IG, nor has IG participated in the creation, review, or validation of this content. All opinions expressed are based on personal experiences and independent research. Trading involves risk, and past performance is not indicative of future results. Readers should conduct their own due diligence and consult with a qualified financial professional before making any investment decisions.

The conditions, instruments, and products offered by IG or any other broker may change over time. We do not guarantee that the information in this article remains accurate or up to date, and we are not responsible for keeping it updated.

What Are IG FUTURES Instruments?

When trading with IG through ProRealTime, different types of instruments are available within the same trading account. In this case, we will focus on the instruments used for our AutoTrading on index markets:

- CFD (Contract for Difference) instruments

- Futures instruments

Important: You do not need a separate account to trade IG Futures. Within the same IG trading account, you can operate both CFDs and Futures simultaneously.

IG Futures are specific derivatives replicating the behaviour of standard futures contracts within IG’s infrastructure and offer a very straightforward setup:

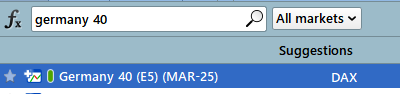

- To find Futures instruments, search for the desired market in ProRealTime and search for a suffix showing the corresponding expiry month (e.g., “MAR-25”, “JUN-25”, “OCT-25”, or “DEC-25”).

- For example, to use the NASDAQ index, instead of “US Tech 100 Cash” (the CFD), you can find the “US Tech 100 (MAR-25)” instrument (the FUTURE)

- You can run the same trading systems on CFD and Futures instruments of the same market by launching separate instances linked to the appropriate instrument. You have the flexibility to combine them.

- No extra configuration is required to use IG futures.

- Broker margins are the same for CFDs and futures instruments on the same market, meaning your capital allocation and risk remain consistent.

This flexibility allows you to easily explore the advantages of Futures without any complex setup, separate accounts, or changes to your existing trading structure.

Key Aspects of IG FUTURES

When considering using IG Futures instruments, understanding the operational and strategic differences from CFDs is essential.

Benefits of IG FUTURES:

- No Overnight Financing Costs

- Futures eliminate daily funding fees applied to CFDs, which is particularly valuable for trades held over several days or weeks.

- Transparent Cost Structure

- Trading costs are straightforward: only consider the spread (usually higher than using CFD, but widely compensated by the overnight fees absence)

- Currency conversion has a cost of 0.8%. Applied in cases where you account base currency is different of the currency of the instrument that you use. That’s the same for CFD instruments, and you can request to IG the change of your account base currency.

- Expiration Awareness

- Futures contracts have set start and end dates, allowing traders to plan rollovers in advance and manage their exposure.

- Adaptability to Certain Strategies

- Swing trading strategies, or those designed to hold positions through multiple sessions without accumulating financing costs, can benefit from Futures. In general, Futures are better suited for positions held for two to three days or longer.

- Standard Margin Requirements

- Margins for Futures are the same as those required for CFDs on the same market, allowing easy risk management and capital planning.

- Seamless Integration with Existing Accounts

- You can access Futures directly from your current IG account in ProRealTime, without needing to open or configure anything additional.

Drawbacks of IG FUTURES:

- Manual Rollover Management

- Futures expire periodically (every 3 months in most cases), requiring active management to close or roll over positions before the contract’s expiry.

- Dividends

- Long positions in index or stock CFDs pay the dividend of that instrument. However, in short positions, those dividends are deducted from our account. In any case, it’s important to note that the cost of holding CFD positions exceeds the dividends we might receive.

- Potential Liquidity Differences

- Depending on the contract and expiry period, liquidity may vary compared to the continuous liquidity seen in CFD markets. On the other hand, initial reviews suggest that IG Futures exhibit lower volatility than CFDs, which could be advantageous for certain strategies.

- Minimum Size Considerations

- While all index markets available in CFDs are also available as Futures, the minimum trade size in CFDs can sometimes be more accessible in certain cases, which may make Futures less suitable for smaller capitals.

Differences Between the Same Markets Using FUTURES or CFD, for AutoTrading

When comparing the performance of the same trading strategies on CFDs versus FUTURES, we observe variations depending on the system and market conditions. As with many aspects of trading, outcomes are rarely black and white and depend on multiple interacting factors.

The key consideration is that CFDs and FUTURES are not identical instruments, even when representing the same underlying market. Differences in data flow, execution, volatility patterns, spreads, and even microstructure noise can affect how an algorithm reacts and executes trades. These variations can influence performance in subtle ways that accumulate over time.

While these results are broadly similar, such differences are normal due to the distinct nature of the two markets. However, it’s critical to avoid focusing solely on profit result shown in the report as the primary comparison metric: It is crucial to understand that BackTest results for CFDs display the gross profit, whereas BackTesting a system on Futures—using the correct spread—provides an estimate closer to the net profit.

Other factors to consider when comparing CFDs and Futures in AutoTrading include:

- Execution Speed and Slippage: Market depth and liquidity may differ slightly between CFDs and Futures, influencing fills and slippage.

- Spread Variations: CFDs might offer tighter spreads in some conditions, whereas Futures have costs embedded within the contract price.

- Market Noise: Small differences in how data is processed or displayed in each instrument type can influence algorithms that are sensitive to minor price fluctuations.

- Drawdown Profiles: Even if profits are similar, the path to achieving them (drawdowns, recovery periods, volatility) might differ.

- Consistency of Results: A system that is highly sensitive to these small factors might experience greater variation between CFDs and FUTURES performance.

The takeaway is that results should always be viewed in context. Profitability is important, but consistency, drawdown management, and overall system stability across different instruments are equally critical when evaluating the suitability of Futures versus CFDs for automated trading. More importantly, certain strategies are better suited for CFDs, while others perform better with Futures.

When to Consider IG FUTURES Over CFDs

IG Futures are an attractive option when:

- You are running strategies designed for medium to long-term trades, where positions remain open for 2-3 or more days.

- You want to avoid overnight financing fees, which can accumulate significantly in CFDs over time.

- You trade well-supported and liquid Futures products, such as major indices, commodities, and key forex pairs.

- You are comfortable managing contract expirations and rolling over positions manually.

- You want to run parallel tests or operations, launching the same system on both a CFD and a Futures version of a market for comparison.

By contrast, CFDs are generally more suitable when:

- Prioritizing continuous market access without the interruption of contract expirations.

- Managing smaller accounts, where more affordable minimum trade sizes are important.

- Preferring a simplified, set-and-forget system without the need for rollover monitoring.

- Specific strategies that could fit better the bigger CFD volatility

Usage of IG FUTURES on our CFD AutoTrading systems

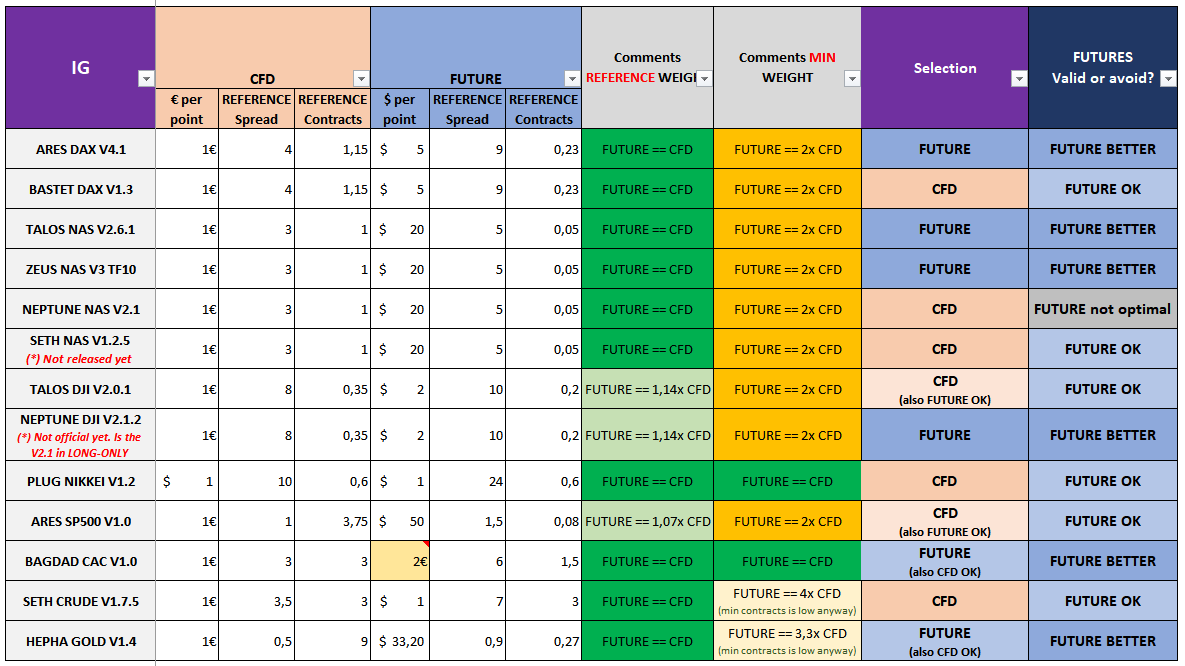

We analysed our current systems using both CFD and FUTURES instruments and determined which option works best in each case. When comparing results, we considered the costs associated with CFD usage and the overall system behaviour. Keep in mind that different strategies may perform better with one instrument over the other due to subtle differences between them.

The table below summarizes the suggested usage of CFDs or FUTURES for each system:

Find updated information in our Discord.

Summary of Conclusions

From internal tests and community insights:

- IG Futures are a solid option for specific systems and trading profiles, particularly where medium-term holding and cost savings from avoiding overnight fees are priorities.

- Effective management of contract expirations is essential to avoid operational issues using FUTURES.

- Futures instruments are readily available within your IG account without additional setup.

- Margins remain the same as CFDs, ensuring consistent capital use.

- CFDs remain the easiest option due to minimal operational work, but their higher costs can have a significant impact. By carefully reviewing different strategies and incorporating Futures where appropriate, traders can optimize their results and profitability in both manual and automated trading.

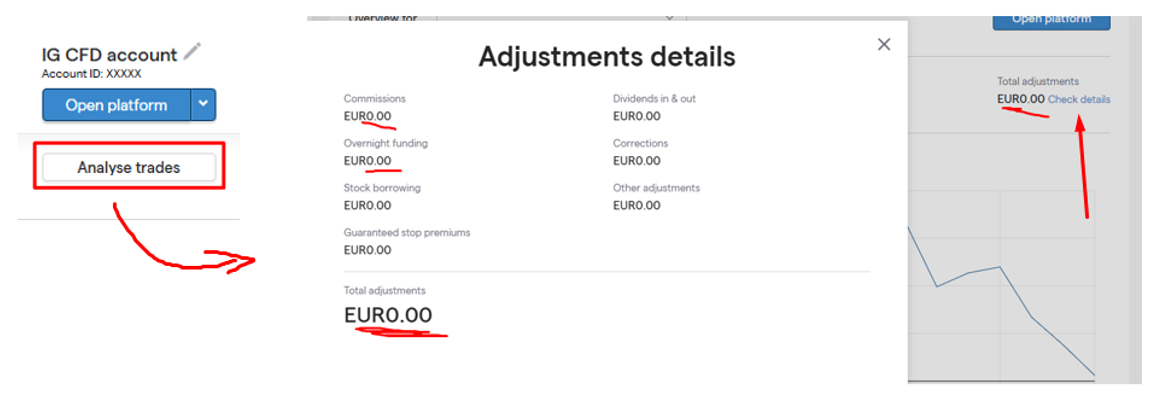

Recommendation: Analyse the costs you had in your account

We encourage you to review the commissions and overnight financing costs incurred in your account over different periods. Compare it with the following screenshot of a small account running only AutoTrading with Futures over a few months.

Got questions?

Join our Discord for real-time insights & discussions!

Ready to Start Automated Trading?

Now that you understand how IG futures work and the potential of automated trading, take the next step toward consistent profits.

Why Choose Our Systems?

- IG Platform Optimized – Specifically designed for IG’s infrastructure

- Full Support – Setup assistance and ongoing guidance

- Risk Management – Built-in position sizing and drawdown controls

Don’t let another month pass watching the markets from the sidelines.