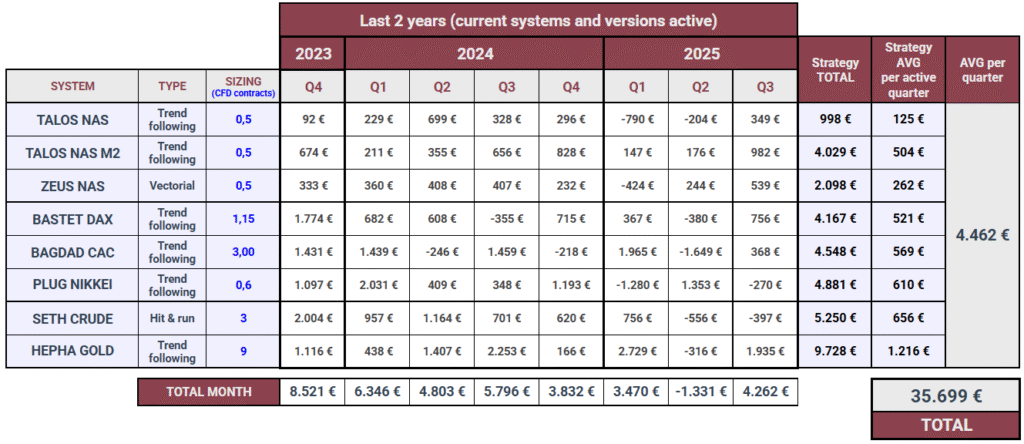

LAST 2 YEARS OF THE CURRENT PORTFOLIO

2025 is being an unusually challenging environment for our systems. Market conditions have been highly erratic, with inconsistent trends and abrupt reversals that have significantly impacted overall performance. According to our HISTORICAL RESULTS, our combined portfolio has lost approximately 5.700€ so far this 2025 — a figure even higher than during the most difficult periods of 2022.

However, this is part of the natural cycle. Our systems — and our selection methodology — have consistently shown their ability to recover and deliver solid results over the long term. We firmly believe that short- to mid-term turbulence must be evaluated within a broader strategic context, where robustness and consistency remain essential.

That said, we continuously review and adjust the portfolio. Throughout 2025, we have made tactical updates and halted underperforming or less reliable systems, resulting in a portfolio better adapted to current conditions and having great potential for 2025’s strong seasonal ending, with the most robust and tested systems, once the problematic ones have been halted.

The following table highlights the currently active systems and versions, offering a clearer view of the portfolio’s present potential.

Analysing the data:

- Over 35.500€ in gross profit in two years, from an initial capital of approximately 15.000€ – achieved in a volatile market, without reinvesting profits, and scalable for larger capital allocations.

- A consolidated and diversified portfolio of 8 systems across 6 global markets, offering long-term stability without unnecessary complexity.

- Access from 2.500€ to run the full portfolio at minimum sizing without commodities, or from just 1.000€ for individual systems, giving flexibility to scale according to your capital and risk preferences.

- A controlled drawdown that, while significant on the last period, can be adapted to your risk acceptance. The combinations are multiple, and you can start from low capital and consider a DrawDown starting at 20-25%.

We remain fully transparent and committed to the long-term evolution of our systems. No shortcuts, no hype — just a data-driven approach and a focus on sustainable, real-world performance.

All the results shown are directly scalable depending on the number of contracts you use. From just 14.000€, you can run all the systems with the sizing shown (you can also start from half-sizing, or exclude the commodities systems). If you need support, we will discuss your case and preferences. Our customers usually launch our systems successfully with considerably lower requirements and initial capital than we show here.