We are so excited by the release of the V2.6, as an update and improvement of version V2.5, after discovering from customer feedback that the system was operating more stably and profitably using a 10-minute timeframe (TF10m) instead of the traditional 5-minute timeframe. After verifying that the better performance in TF10 was not just due to chance, carefully studying it and reviewing entries and exits, we decided to release version 2.6 which basically shifts to TF10m, along with minor additional improvements we had previously been studying. Note that with ZEUS NAS, although it is a different strategy and therefore its signals are others, a change was also made to TF10m from TF5m with very accurate results, also stabilizing the behaviour with more accurate trades and therefore improving profitability. Here is the complete list of changes for this V2.6 of TALOS NAS:

- Moving to using TF10m (previously TF10m)

- Reoptimizing trailing, especially in short positions, where a new type of entry is added for shorts, through a new signal for more effectively seeking shorts during bullish retracements (involves only a few additional trades).

- Reoptimizing seasonality and time filters

- Increasing the “LongShortMaxFactor” property from 0.5 to 0.6 to give a bit more weight to the shorts (although longs still have more weight by default).

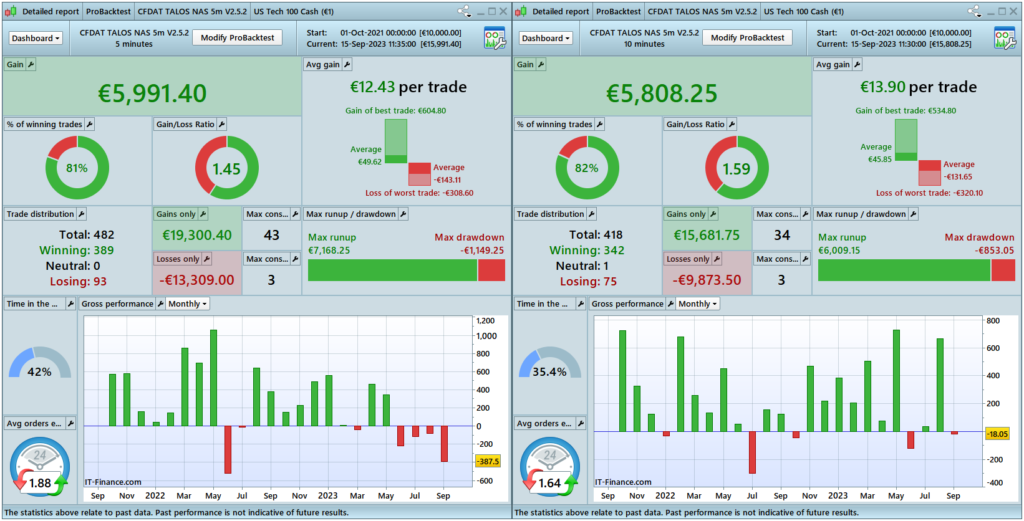

First, let’s look at why the change to TF10. Let’s see how the current V2.5 version performs in both TF5 and TF10 over the last two years (see next image). Although the end profit may seem similar, the improvement is precisely in achieving the same profit with less DrawDown, fewer trades, and less time in the market. And also, the last year 2023 is especially more profitable.  Now let’s look at the comparison between the previous and the new version, for 200k candles, which is 100k in the case of TF10m, so that the comparison period is the same. It’s worth noting that the months that appear negative in the BT of V2.5 had better performance in the real account, resulting in flat profits. Also consider that the OutOfSample for V2.5 has been since its launch in November 2022 (its real profit exceeded 1,000€ per contract at the time of launching the new V2.6).

Now let’s look at the comparison between the previous and the new version, for 200k candles, which is 100k in the case of TF10m, so that the comparison period is the same. It’s worth noting that the months that appear negative in the BT of V2.5 had better performance in the real account, resulting in flat profits. Also consider that the OutOfSample for V2.5 has been since its launch in November 2022 (its real profit exceeded 1,000€ per contract at the time of launching the new V2.6).  Noteworthy in the V2.5 to V2.6 comparison in the previous image is that, in addition to the improvements introduced with the shift to TF10, DrawDown is further improved, and especially the profit/loss ratio is improved. And this is how the final BT of 200k candles (standard in retail accounts) looks in the 1M mode of ProRealTime Premium (see next image). As you can see, even going back four years, the behaviour remains intact, and the DD is reduced.

Noteworthy in the V2.5 to V2.6 comparison in the previous image is that, in addition to the improvements introduced with the shift to TF10, DrawDown is further improved, and especially the profit/loss ratio is improved. And this is how the final BT of 200k candles (standard in retail accounts) looks in the 1M mode of ProRealTime Premium (see next image). As you can see, even going back four years, the behaviour remains intact, and the DD is reduced.  Do not forget that, as we have communicated in articles, social media and emails, TALOS NAS continues to be even more reliable in its LONG-ONLY configuration, launching only long trades. Although the statistics for the next BT of the LONG version are similar, the long side has ALWAYS performed better and more stable in real. Since the previous version V2.5, you can configure to launch shorts with a smaller contract size. However, launching an additional instance of only shorts is still a good option (in any case, always considering the contract size and resulting risk). Here is the LONG-ONLY version (which is easily configured with a single property)

Do not forget that, as we have communicated in articles, social media and emails, TALOS NAS continues to be even more reliable in its LONG-ONLY configuration, launching only long trades. Although the statistics for the next BT of the LONG version are similar, the long side has ALWAYS performed better and more stable in real. Since the previous version V2.5, you can configure to launch shorts with a smaller contract size. However, launching an additional instance of only shorts is still a good option (in any case, always considering the contract size and resulting risk). Here is the LONG-ONLY version (which is easily configured with a single property)

Please note that the new short input type can be deactivated. In the specific TALOS NAS configuration section, in fact, you can find additional configurations, if you wish to try different combinations:

Want to see all the statistics in detail? Launch and analyze the strategy yourself using our demo: cfdautotrading.com/demo